Regulatory reporting is the reporting that all banks are obliged to provide to the banking authorities. These reports compile all bank data so that the banking authorities can be informed about the bank’s state of health.

Various software packages are available to assist in the preparation of reports to be provided to the banking authorities.

We mainly work with software from the Sopra Banking Software “Compliance” range

Banking reporting software packages are necessary for any banking and finance entity, facilitating their monthly, quarterly and annual financial reports to the banking authorities (Prudential Control Authority, European Banking Authority…).

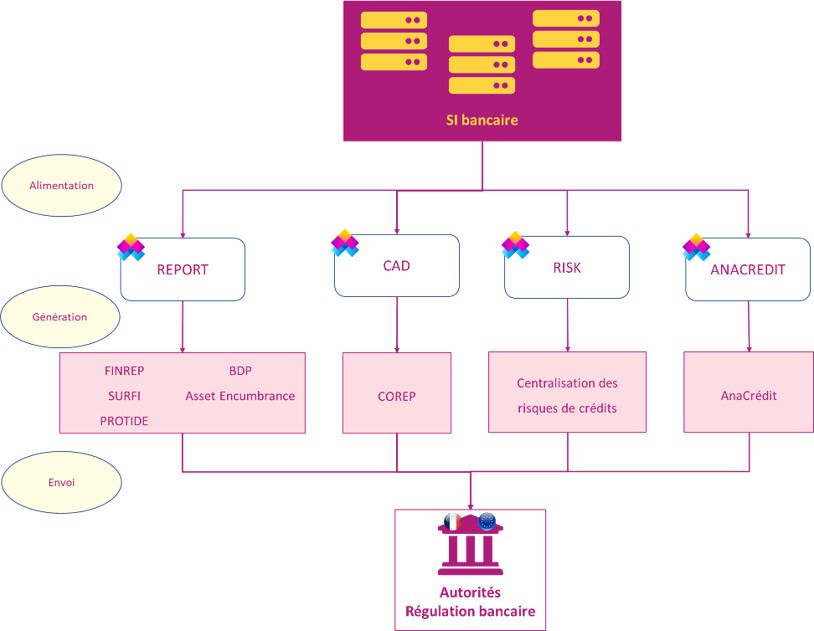

In this context, we work with our clients, mainly on software from Sopra Banking Software’s Compliance range, in particular REPORT, RISK, CAD, and AnaCredit to cover all the actions required for their smooth operation:

In order to respond to all the problems that may be encountered when using the software packages, we provide technical support.

Indeed, our technical expertise allows us to find long-lasting solutions to facilitate the future use of the products. Annual packages can be set up to meet all your needs.

Regulatory reporting is bound to evolve in line with French and European legislation. Regulatory reporting tools must therefore be regularly updated through patches or new versions.

We provide you with our expertise to deploy these updates and their configuration, in order to ensure the proper functioning of these products over the long term.

It is a solution developed by the American company Calypso. Intended for the world of market finance, it is widely used by corporate and investment banks.

This front-to-back software package covers trading as well as risk management and accounting for all financial products. These functionalities also allow for collateral and position management.

It is modular, allowing each bank to implement only those functionalities that interest it (certain products or only the back-office activity for example). This modularity also allows for greater robustness (a faulty module does not lead to a complete shutdown of the application). The lifecycle modeling of the different products is done in the form of a workflow, which makes customization easy. Being completely developed in Java, the customization of the software package is greatly facilitated.

Rades can intervene as project owner for :

Rades can act as project main contractor for :